While it is easy to get into the forex market, it is not as easy to master it. Many beginners tend to make a lot of mistakes as they try to establish a foothold on the market. A lot of newcomers tend to get discouraged even before they have succeeded in building up a foundation. Most of the mistakes that beginners make are not very complex though. With a keen focus, they can be avoided. The following is a highlight of the key mistakes beginner traders make and which should be avoided.

Many beginners also tend to focus too much on the short term trade. This is because of the general perception that day trading is all about going for the short term trades. While forex trading is indeed largely beneficial for short time spans, it is not a wise move to ignore the longer time frames. These time frames tend to give a better picture of uptrends. The hourly and daily charts are specifically great when it comes to showing the trends. Traders who focus too much on the minute-based charts, therefore, end up missing important data.

1. Making Big Risks

A lot of people tend to venture into the forex market thinking that it is some sort of gamble. They risk too much money and they end up getting burnt. Such beginners also tend to have too much optimism in the market. All these are mistakes that end up consuming them. You should never risk too much of your money in the forex market. This market, unlike many others, is very volatile and risky. Like other markets though, the forex market can be beaten with a smart strategy.

2. Failing to Utilize Longer Time Frames

Many beginners also tend to focus too much on the short term trade. This is because of the general perception that day trading is all about going for the short term trades. While forex trading is indeed largely beneficial for short time spans, it is not a wise move to ignore the longer time frames. These time frames tend to give a better picture of uptrends. The hourly and daily charts are specifically great when it comes to showing the trends. Traders who focus too much on the minute-based charts, therefore, end up missing important data.3. Choosing the Wrong Platform

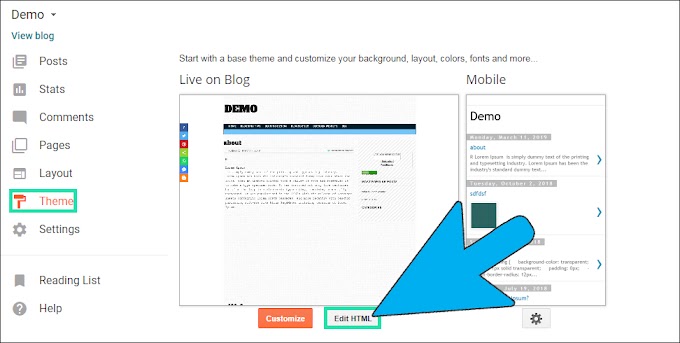

Another mistake that traders often make is choosing the wrong platform. Forex trading is a difficult affair when you don’t have the right trading tools. A platform is a crucial part of your success in the trade. As a beginner, you need a solid platform that has news, educational information, different charts, and all the tools required for analysis. Metatrader 4 is the most commonly used forex trading platform. In order to use the platform properly though, you need to go through a MetaTrader 4 guide to understand it. After all, every beginner should ensure that learning is the most essential part of their daily trade.